Get solar financing that wins you more customers

Close more deals with tailored solar financing options built to achieve positive cash flow – without finding funders and managing applications yourself.

>130 Funders

5 to 10 years

$100,000+

6.99%

EnPowered enables contractors to find the best solar financing options and improve their customer-funder experience.

Flexible solar financing for commercial contractors, designed for cash flow positivity and fewer barriers to closing customer deals.

How would my clients benefit from solar financing?

Demonstrating you can find and break down expensive capital costs into affordable and understandable financing options increases a client’s perceived purchasing power.

We provide the platform to do it.

Optimized deals

Deal structures are designed to unlock all available incentives and rebates.

100% funding

The entire project can be financed with no money down with full construction financing for the contractor.

No liens

Funding security is based on the solar asset itself, not taking a lien on other business property or assets.

Instant results

Our AI-assisted underwriting process tells you the likelihood of getting a project financed by any funder in the industry within 24 hours of application.

"Working with EnPowered has been fantastic. The Financing Accelerator platform empowers our sales team to offer financing options at the point of sale. Their Account Executives' professionalism and exceptional communication truly stand out, making their customer service unique and attentive, with sharp turnaround times and availability to facilitate the sale. These attributes are hard to find in a financing partner."

Jason Dykstra

CEO, Redwood Energy Solutions

Financing Accelerator platform

Our AI-powered Financing Accelerator platform facilitates access to a massive network of supporting funders to help commercial solar contractors navigate complex financing pathways and find the best solution to meet customer’s goals.

Achieve positive cash flow

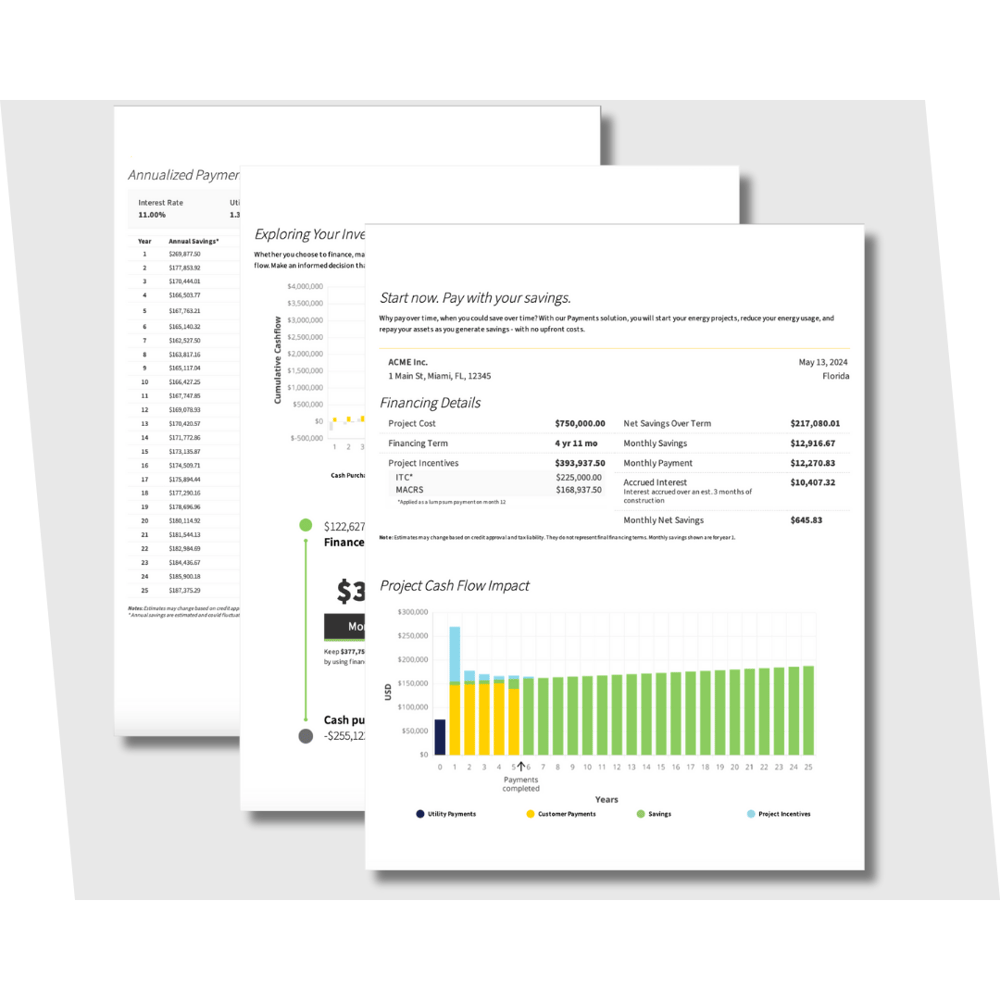

We match you with the ideal funder who can leverage all rebates and incentives to get the most attractive solar loan possible for you and your customer.

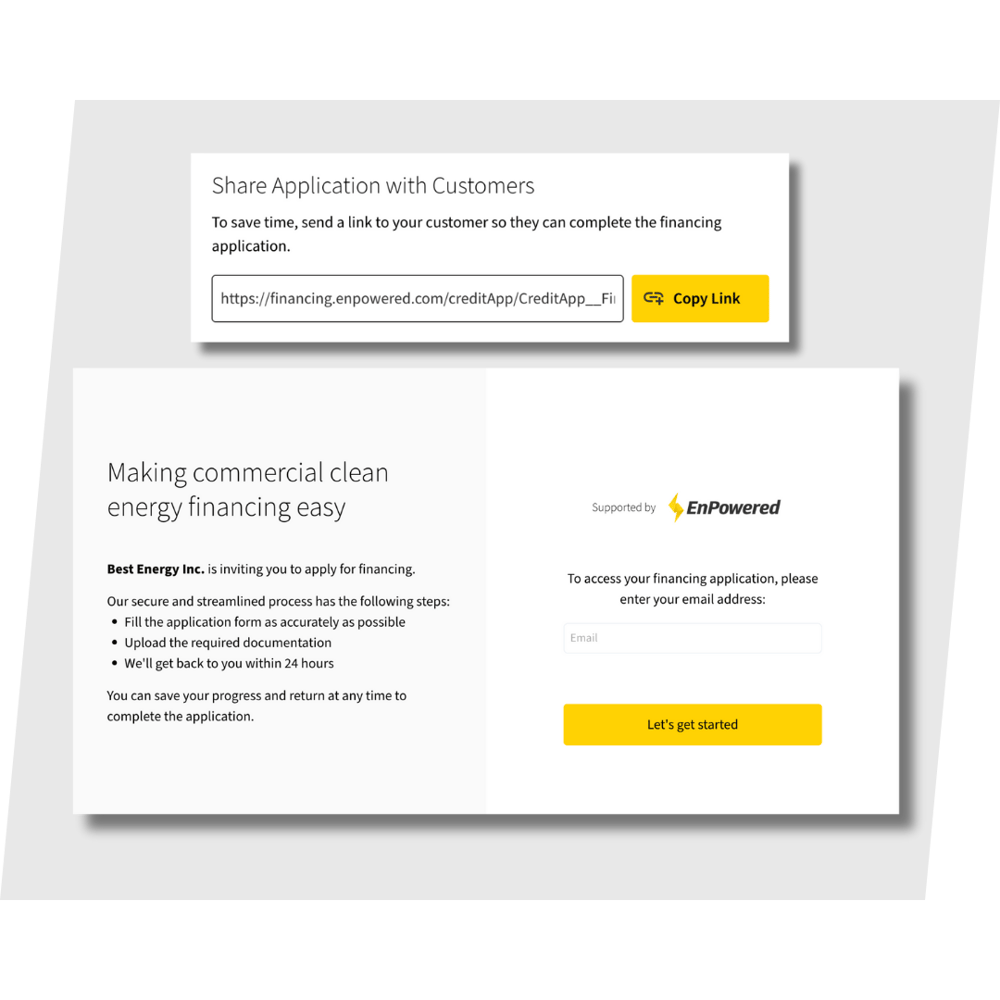

Improve the application experience

Through Financing Accelerator, we streamline credit applications, manage documentation, and generate instant funding solutions that motivate customers to buy.

Get business-friendly rates and terms

We take the guess work out of understanding commercial solar financing interest rates and terms to create proposals that help close deals.

Grow with complimentary services

We go beyond lenders and banks with growth services that win customers over: custom funding packages, sales training, and co-branded marketing materials.

"Thanks to EnPowered’s no-money-down funding platform, we've eliminated barriers, offering solar systems without upfront costs. This partnership has boosted leads and customer interactions for us. Their exceptional support and solid communication streamline the whole funding process, making working with them truly remarkable."

Lyle Ciardi

President & Co-Founder, Community Solar Advisors

Solar financing for contractors FAQs

In today’s competitive, cost-constrained market, clients are more cautious about purchasing solar hardware, leading to more lost deals for contractors than ever before.

Our integrated financing opens up access to a wide range of funders and flexible funding options that reduce the barriers to funding and eliminate many of the process frustrations – helping you close more deals.

We offer a range of solar loan options with flexible rates and terms structured to achieve positive cash flow.

We work with a large funder network to bridge the gap between you and the customer to find the best financing option and eliminate frustration.

Through this network, we create custom funding packages that fit your target market and provide access to Financing Accelerator to create instant financing proposals supported by tools to streamline the application process.

We structure deals to maximize all available incentives and rebates and find funders with business-friendly terms and rates to minimize the project's cash flow impact.

Our massive funder network ensures you get a funder that supports these goals.

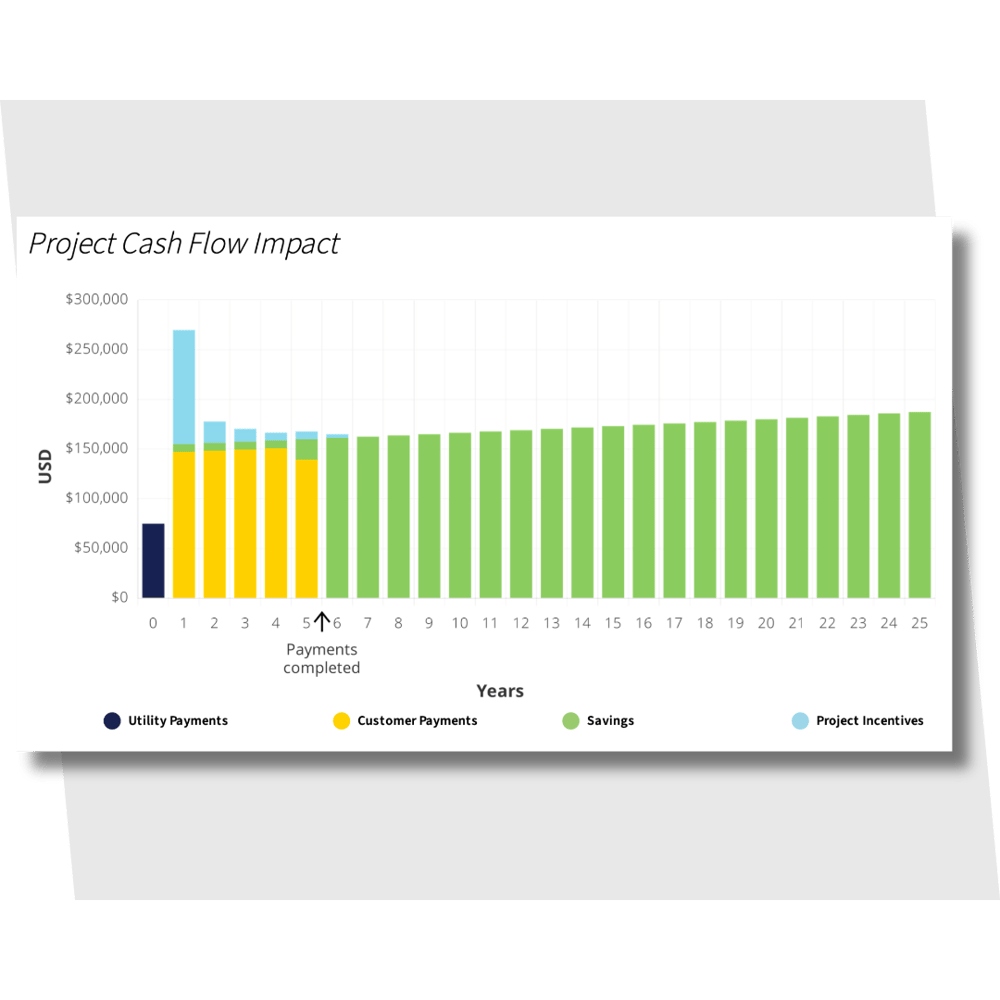

We use a number of levers, including rebates, incentives, your customer’s tax appetite, and project timelines, to minimize the solar project’s impact on cash flow.

We work with our funder network to find the best funding partner and leverage Financing Accelerator to create proposals designed to close your deals.

We provide solar loans, leases, and Power Purchase Agreements (PPA).

Solar loans are the most popular for commercial customers as ownership of the hardware allows them to unlock all available incentives and rebates.

Book a demo and get started with EnPowered today!

Business-friendly rates and terms

You can create tailored solar financing solutions with rates and terms that win them over.

Built to compete

We help you stand out in the marketplace by eliminating the solar financing barriers and application headaches for customers.

Selling confidence

Your solar funding offerings are backed by one of the largest clean energy funder networks in North America, structured to optimize cash flow, leverage incentives and rebates, and present business-friendly terms and rates.

Instant sales support

We integrate with your sales people and process, including credit pre-check and pre-sales tools that eliminate the prospect qualification guesswork.